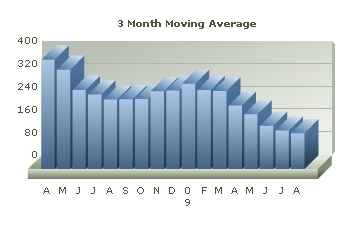

Sep. 4, 2009 -- Mortgage rates ended summer on a softer note, drifting back to late-spring levels. A pause (at least) in stock markets after a strong summer run saw some investors shift cash from equities into less-risky investments to lock in gains, driving influential Treasury yields lower.

The overall average rate for 30-year fixed-rate mortgages revealed in HSH's Fixed-Rate Mortgage Indicator (FRMI) nudged downward, slipping seven basis points (.07%) to close the first week of September at 5.56%. The overall average for 5/1 Hybrid ARMs lost five basis points to landing at 4.87%. Conforming 30-year FRMs finished the period at 5.25%, a level last seen in late May.

Construction Spending fell by 0.2% in July, while outlays for commercial properties declined by 1.7%, and public outlays slipped by 0.7% as state and local governments struggle with revenue shortfalls. Some stimulus money will probably be making the "roads and bridges" circuit before long, but true "shovel ready" projects which might use that money have turned out to be few and far between, aside from repaving and filling potholes. One bright spot in the report was spending on residential projects, which climbed by 2.3%, the second positive reading this year. With new home sales firming from desperate lows, at least some new homes must be built to replenish inventory in the most desirable segments of the housing market.

Mortgage rates have slipped back to the levels seen last spring. If they hold through the next couple of weeks, we should see a seasonal resumption in activity, particularly for refinances. If the equity rally is substantially over for now, awaiting confirmation that the economy is ready to power forward, that should be good news for mortgage rates.

While mortgage rates would have to fall a lot more to revisit the attention-getting levels we saw earlier this year, we are nearing the point at which could we could see some additional activity. The trend has been mostly flat-to-down in recent weeks, and that should be the case for next week.

Leave A Comment